Pension

Pensions Transparency Award

Hutto Fire Rescue Recognized is the latest local

government entity to achieve a Transparency Star as recognition of excellence in Public

Pensions.

Public Pension System

Williamson County Emergency Services District #3, a State of Texas Special Purpose District, has participated in the Texas County and District Retirement System (TCDRS) since 2010. TCDRS was created by the Texas Legislature in 1967. TCDRS helps more than 380,000 Texans plan for their future through partnerships with counties and districts to provide retirement, disability and survivor benefits. TCDRS serves 253 Texas counties and 595 diverse districts — such as Williamson County Emergency Services District #3. Providing attractive retirement benefits helps Williamson County Emergency Services District #3 competitively hire and retain talented staff.

Since TCDRS was created, they have grown into a financially strong, multi-billion-dollar trust with nearly 850 participating employers such as Williamson County Emergency Services District #3. TCDRS employers advance fund their plans over the length of their employees’ careers so their employees can count on their benefits when they are ready to retire. TCDRS is considered one of the best-funded retirement plans in the nation; they do not receive state funding. Each plan is funded by investment earnings (74%), the employer (15%) and its employees (11%). Benefits are responsibly funded, which means costs are not pushed to future generations. TCDRS consistently exceeds their portfolio benchmark. For example, a 35-year return at 8.6% for the period ending Dec. 31, 2021.

Williamson County Emergency Services District #3 retirement plan through TCDRS is built-in on three features that make it financially strong.

-

- SAVINGS-BASED: Williamson County Emergency Services District #3 employees save for their own retirement over the length of their careers. The TCDRS benefit is based on the final savings balance and employer matching. This is contrary to a traditional pension based on final salary where a late-career promotion or excessive overtime can increase employer costs beyond expectations.

- RESPONSIBLE FUNDING: Williamson County Emergency Services District #3 pays 100% of their required contribution every year. This ensures that the necessary funds will be there when the time comes to pay benefits upon separation from the organization.

- FLEXIBILITY AND LOCAL CONTROL: Williamson County Emergency Services District #3 can adjust benefit levels to meet workforce needs and budgets. This level of flexibility is not standard in most traditional pension plans.

As of Dec. 31, 2022 TCDRS’ net assets were $42 billion. Their portfolio is constructed to achieve their long-term return goal within acceptable levels of risk. By meeting their goals, they help employers provide meaningful, secure benefits to their employees and retirees at reasonable, predictable costs. TCDRS investment returns and net of all fees include the following:

|

ANNUALIZED RETURN |

2023 RETURN |

RETURNS AS OF DEC. 31, 2023 | ||||

|

3 YEAR |

5 YEAR |

10 YEAR |

20 YEAR |

30 YEAR |

||

|

Total Fund |

11.08% |

8.48% |

10.46% |

7.76% |

7.33% |

7.57% |

|

Policy Benchmark Portfolio |

11.34% |

5.98% |

9.17% |

6.60% |

6.48% |

6.54% |

Effective March 2023 the TCDRS investment portfolio provided broad diversity to reduce their total exposure to losses from any single asset class or investment.

In 2023, TCDRS paid $2.3 billion in benefits to retirees and former members, and 96% of that money stayed in Texas.

Williamson County Emergency Services District #3 most recently completed fiscal year for which data is available: 2023

- Williamson County Emergency Services District #3 funded ratio from most recent actuarial valuation: 90.85

- Williamson County Emergency Services District #3 amortization period from most recent actuarial valuation: 15.4

- Williamson County Emergency Services District #3 one-, three- and 10-year rates of return, with link to basic explanation of methodology employed:

- One-year rate: 11.1%

- Three-year rate: explanation: 8.48%

- Ten-year rate: 7.76%

- Williamson County Emergency Services District #3 assumed rate of return: 7.50%

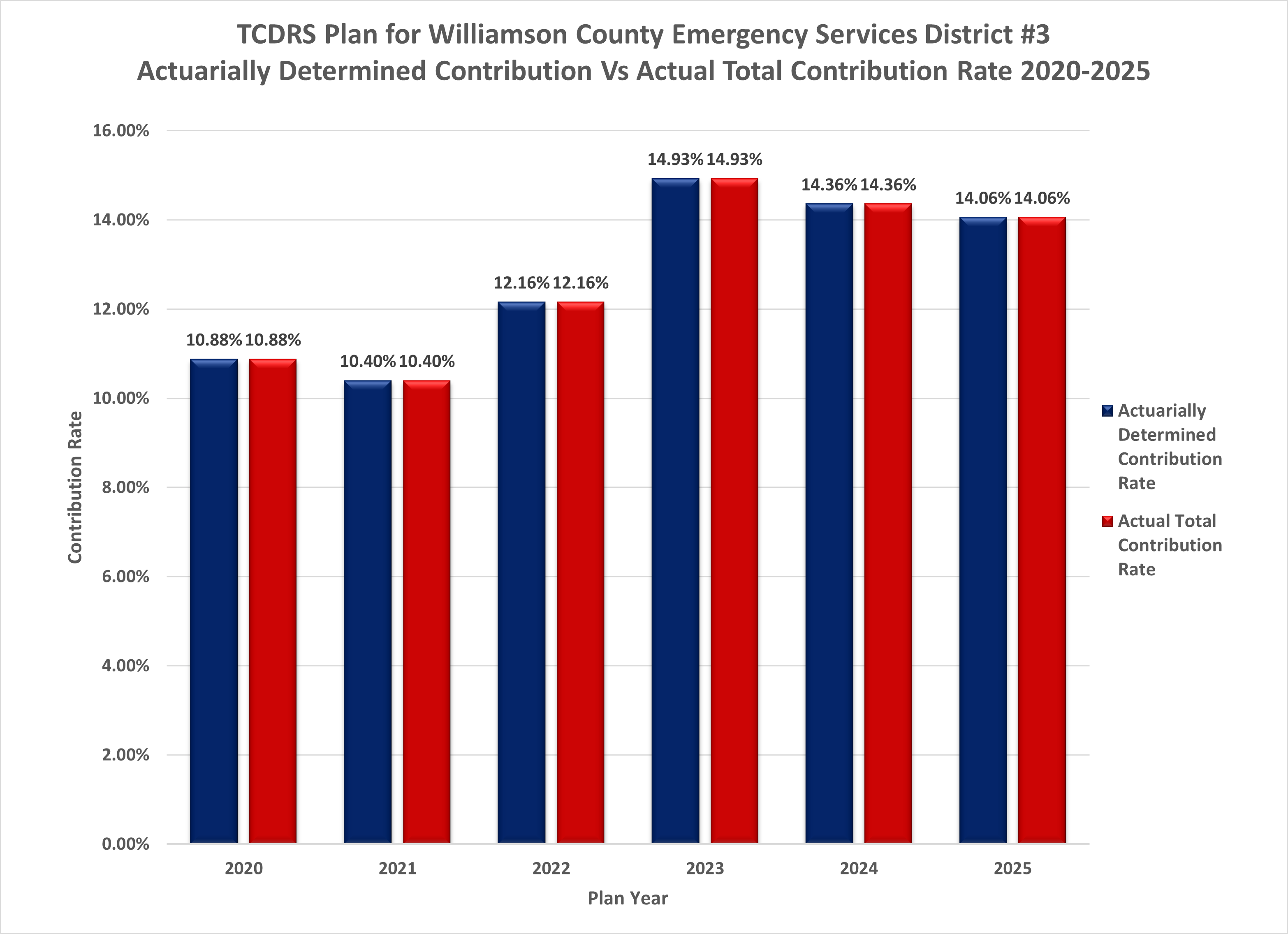

- Williamson County Emergency Services District #3 Actuarially Determined Contribution (ADC) Rate from most recent actuarial valuation: 14.36%

- Williamson County Emergency Services District #3 current total Contribution Rate from most recent actuarial valuation: 14.43%

- Williamson County Emergency Services District #3 Unfunded Actuarial Accrued Liability (UAAL) as percent of covered payroll from most recent actuarial valuation: 3.64%

TCDRS investment return results

TCDRS investment results explanation of methodology

Texas Comptroller of Public Accounts Public Pension (Total) search tool

Texas Comptroller of Public Accounts Public Pension (TCDRS only) search tool

Williamson County Emergency Services District #3 Documents and Reports

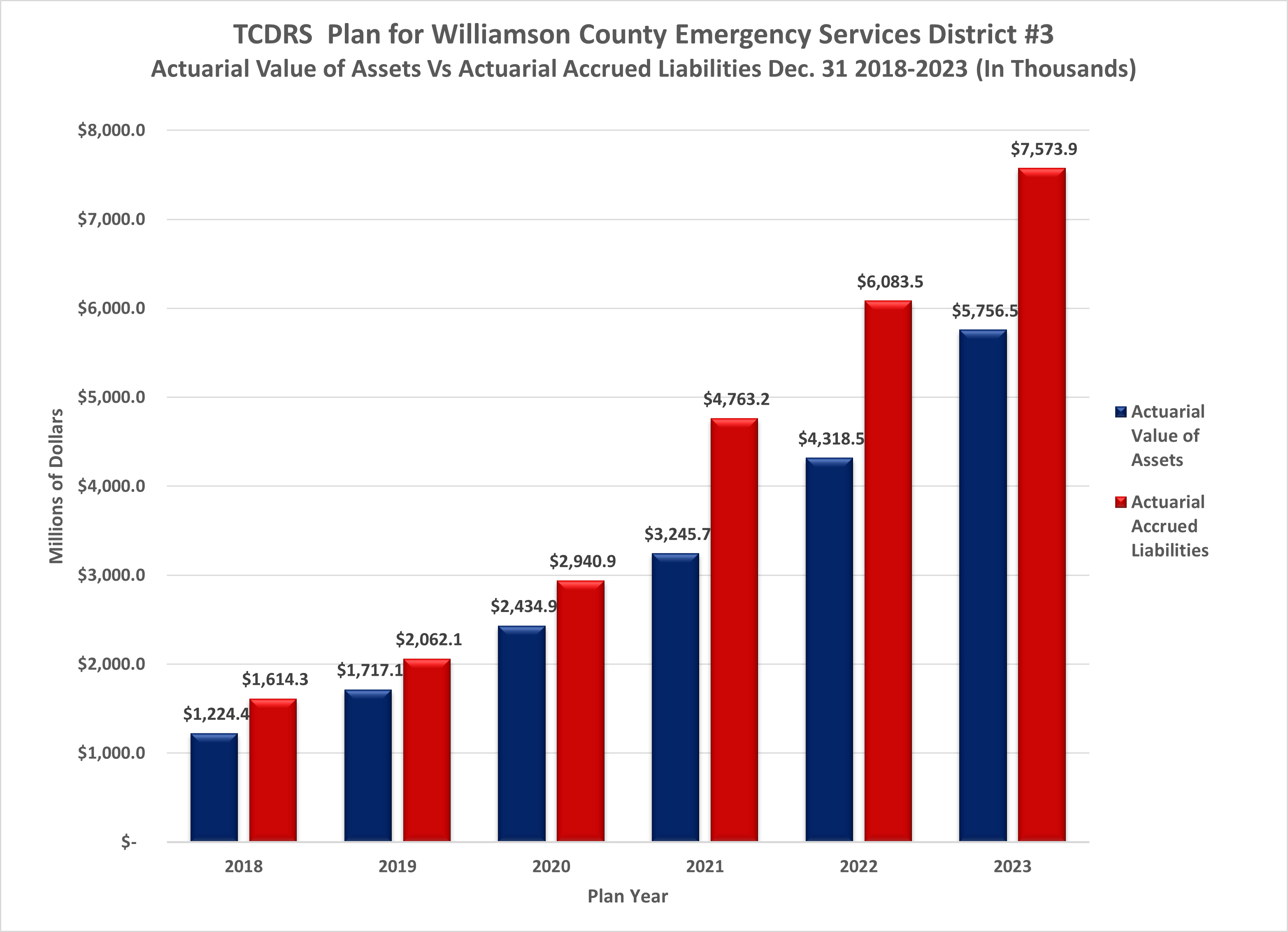

WCESD #3 Actuarial Accrued Assets vs. Actuarial Accrued Liabilities 2018-2023

WCESD #3 Actuarially Determined Contribution Vs Actual Total Contribution Rate 2020-2025

- WCESD #3 Actuarially Determined Contribution Vs Actual Total Contribution Rate 2020-2024 (Raw Data)

- 2023 TCDRS Schedule of Chnages in Fiduciary Net Position by Employer

- 2022 TCDRS Schedule of Changes in Fiduciary Net Position by Employer (Total)

- 2021 TCDRS Schedule of Changes in Fiduciary Net Position by Employer (Total)

- 2020 TCDRS Schedule of Changes in Fiduciary Net Position by Employer (Total)

- 2019 TCDRS Schedule of Changes in Fiduciary Net Position by Employer (Total)

- 2018 TCDRS Schedule of Changes in Fiduciary Net Position by Employer (Total)

- 2018 WCESD #3 Plan Assessment

- 2019 WCESD #3 Plan Assessment

- 2020 WCESD #3 Plan Assessment

- 2021 WCESD #3 Plan Assessment

- 2022 WCESD #3 Plan Assessment

- 2023 WCESD #3 Plan Assessment

- 2018 WCESD #3 Summary Valuation Report

- 2019 WCESD #3 Summary Valuation Report

- 2020 WCESD #3 Summary Valuation Report

- 2021 WCESD #3 Summary Valuation Report

- 2022 WCESD #3 Summary Valuation Report

- 2023 WCESD #3 Summary Valuation Report